Seven Tips for Forecast Credibility

A CRITICAL CRITICAL Topic

‘THE FORECAST’ is so important for all sales and business leaders. Your credibility will be judged directly on how well you manage the forecast process. CEOs have been fired for missing their forecast as have many others down the line. We have all seen or been that Sales Leader or Business Leader that has their forecast pulled apart by senior management during a review and loses credibility in the process. And we know credibility is easy to lose but very hard to regain. Senior management are not impressed by forecasts, strong or weak, that aren’t backed up with credible support and data points. I hope to share some valuable insight here that will help you get ahead of the curve and avoid this situation.

This article will give you some direct and actionable tips for managing your forecast ‘in the quarter’, I will share tips for longer range forecasting and planning at a later stage.

Triangulation

I will never believe a forecast from just a single source, I want to have strong triangulation and have multiple inputs into the forecast process. We should have a system where we are cross-checking a range of inputs to come up with our forecast.

Here are SEVEN Bottom Up factors to consider :-

1. Sales Team Input

Of course this is a hugely critical input and provides us a good starting point since the sales team are closest to the customer and the deals, and very directly accountable for the outcome. BUT I still always want to cross-check what the sales team is telling me as they often have reasons for being conservative or aggressive on the forecast. Maybe it is coming up to the time we set quotas for the upcoming quarter or new financial year so the sales forecast may come in conservative, or maybe a high forecast will guarantee an allocation of an in-demand product. There are also many other reasons, so while we may put a high weighting on the sales input we should fully consider other inputs.

2. Customer Feedback

Getting customer feedback as directly as possible is obviously key to getting a handle on the forecast. Management can not judge a forecast from the headquarters office, and unless they can get in front of key customers and across key deals personally then they will have a big disadvantage. This applies to senior sales line management and GMs, as well as the supporting functional leaders. The product marketing lead or professional services lead can come back from customer meetings with valuable input.

3. Sales Activity

Many businesses have key leading activity indicators that give a sense of how strong your results will be. These could be inbound calls, outbound calls, new leads, customer visits, numbers of quotes, value of quotes, new accounts signed or any number of other metrics that work for your business. Compare the relative strength of these indicators with previous quarters to get some valuable insight on your prospects in the current quarter.

4. Order Rates & Momentum

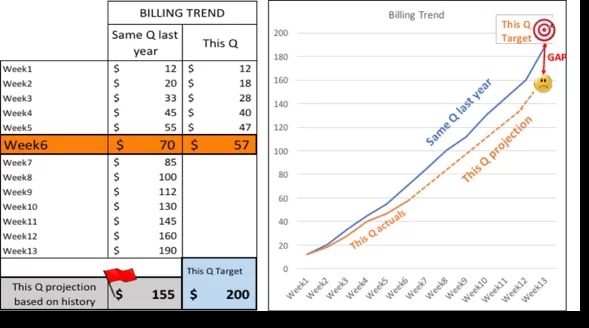

We should study our actual order rates and how they compare to historical levels. Below table is an example of how we might look at it. Let’s say we are in Week 6 and needing to project our forecast for the full quarter. The orange boxes show our bookings at Week 6 are substantially below the same point in the same quarter last year, only $57 million vs $70 million last year and our target is higher than last year. And based on the historical trend we will only hit $155 million for the full quarter and be well short of our $200 million target.

This is a simple example and I would want to do comparisons with a few other quarters as well to be sure to get a valid comparison. Again this is a single data point that we put into the mix with the other data. For example, we might have a stronger pipeline this quarter compared to other quarters or you have personally met with a big customer who has committed the orders that will close the gap.

5. Pipeline Status

The pipeline can give us a very data-based input on the forecast. We can run a lot of analytics on the pipeline, we can back-test the current pipeline against prior quarters pipeline vs actuals, or historical close rates vs pipeline weightings and so forth.

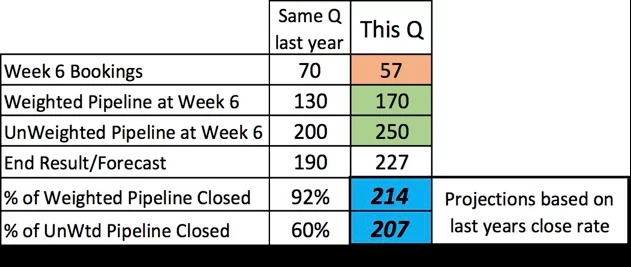

Below table is a simple pipeline analysis which builds on above situation in Week6 of the current quarter. As per above we are well behind on current bookings, only $57million vs $70million at the same time last year. BUT our Total Pipeline and Weighted Pipeline are well ahead of last year. If we add current bookings plus the Weighted Pipeline we have a forecast that exceeds our target. And if we use historical close rates we get a range of projections, in the blue squares on the right side, which are telling us we should well exceed our target. So now things are not looking so bad.

This is a simple comparison and in reality I would want to back-test against 4-8 previous quarters in stead of just one, and get a good feeling for where we might land. But again let’s use it as one input, for a start it is the sales team that are populating the pipeline data and as per above this could be skewed.

6. Product And/Or Marketing Team Input

The product management and marketing teams can give you excellent input on the forecast so I always like to have them in the key forecast meetings. The product team have a good sense of which products are doing well, which products are bringing incremental revenue vs replacement revenue and a lot of other good input. Having the product team prepare a forecast and cross-checking that against sales is always a constructive( sometimes constructive tense!) exercise. The marketing team can give a lot of input on the strength of any campaigns, lead generation or other key activities that will affect our forecast.

7. Operations/Delivery Team Input

I always want the Operations or Delivery team to be present in the forecast review. They often have valuable information on product availability or delivery resource capacity. I have seen situations often where sales is forecasting a big order but the Ops team will say it can’t possibly be delivered in the quarter or Service Delivery will say they don’t have the capacity to make it happen. If we can surface these issues early enough we may be able to take a recovery action, say borrow stock from another customer or divert demand to a similar product.

Conclusion

The first question anyone gets when putting forward their forecast will be ‘how did you get to that number?’, or ‘what’s your confidence in that number?’. I hope that by calling on a range of inputs and data points as outlined above you will be well prepared for these questions.

Forecasting is so central to quarterly driven sales organisations, especially in Tech, that you must make it a strong institutionalised capability across your organisation.

Happy forecasting and best of luck for the coming quarter!